last updated: jan 9, 2022

Hi, Hello and Namaste to all of you self-aware folks who decided to take a step towards learning (and maaybeee) implementing one of these few money constructs & budgeting tips I’m going to share over the course of these few minutes. Now, I know that I've only seen so much over the past 1.5 years handling my own money but off-late I’ve realised that there are a lot of young adults who struggle with their finances. I might know 1% more than you do – but regardless, in an ode to get 1% better today, read on.

When I think about money, I always have a few things in black & white while the rest lies in uncharted territories, and it has been a rather late realisation that a lot of how you manage your money roots back to your relationship with it –

“Do you come from a privileged background where you always asked for money on demand? Have you ever had pocket money in life? Did you only get money on festivals to splurge on yourself? Did you work through school/college to cover your own expenses? Do you think twice before spending money on luxuries? Do you live pay-check to pay-check, do you fail to spend wisely? Do you just have some lump-sum capital in the bank you should've invested months ago? Do you manage every rupee effectively? Have you ever made money by side-hustles or any small venture in life? Did you witness a financial crisis or cash crunch at home during your impressionable years? Did you start making a few hundred rupees early in life?"

There are so many possibilities, yet we’ve experienced so little.

The chances that you relate with at least one of these questions here are high – and depending on how your relationship with money has been, you need to look at your $$ pain points & get on to solving a few of them. Trust me, it’s not that hard - frivolous spending habits can be taken care of quicker than you think, all you need to know is the power of compounding (wink wink)

Enough of tete-a-tete, let’s delve into a few mental models, budgeting tips & hacks you need to know about. I’ll take this up in 3 sets:

1. Personal finance set-up

2. Mental constructs

3. Hacks

Making sure you are doing all things right with your money is almost impossible, there is always this 1% of uncertainty which drives the anxiety off the roof (situations like, is a crash coming soon? Should I cash out?) but a healthy personal finance set-up will leave lesser room for panik & a much, much wider scope for being financially secure, here’s what i know, implement & think about it.

Personal Finance set-up:

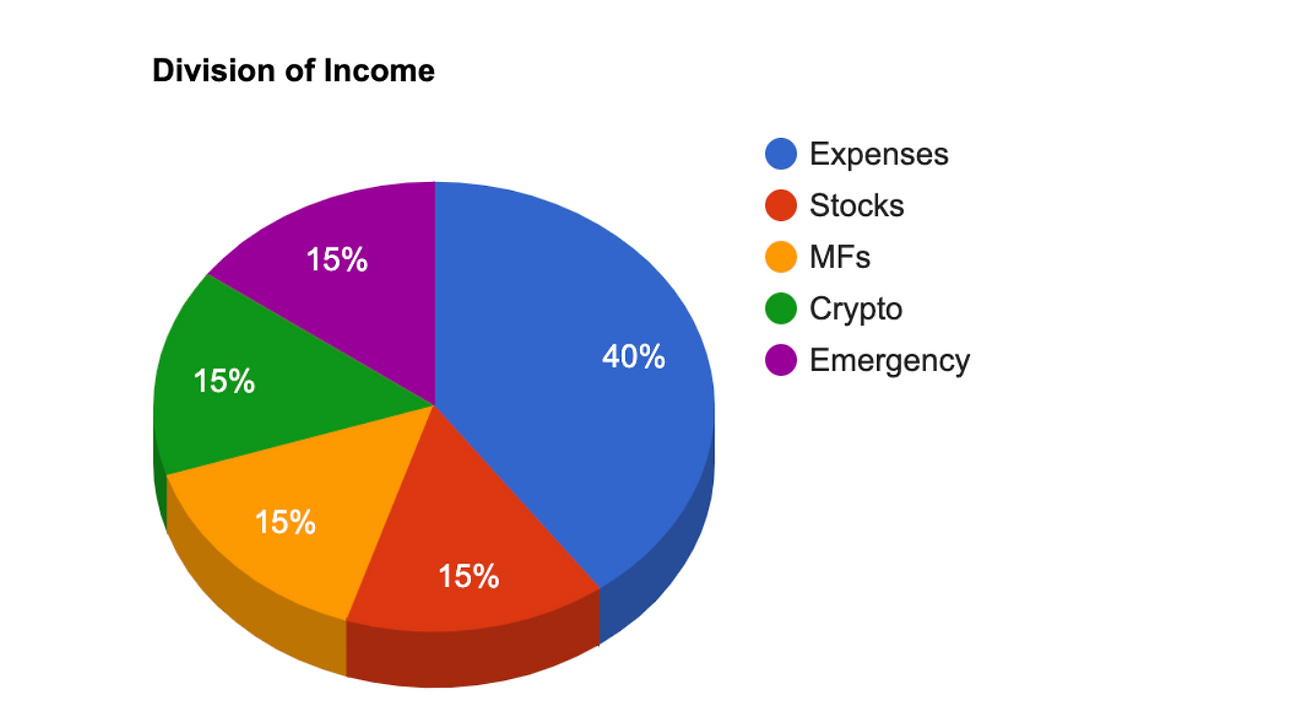

This one is a no brainer, but always remember to divide your salary into multiple buckets, my breakdown looks something like this:

Emergency essentially helps me buy the dips or apply for IPOs (in-case i’m not doing either, it acts as liquidity in times of trouble)

I choose to hold 3 cards (2 debit cards, 1 credit card) which helps me make sure I’m not getting confused or misplacing my money: one for all my expenses (with a UPI ID, safe to imagine, it dries up really fast), one to hold the emergency funds + idle cash, if any and one credit card for big-ticket purchases. The reason I maintain multiple accounts is to make sure I’m not tampering with the set-up at all. Trust me, it works!

The only reason to use a credit card is to build a decent-ish credit score in hopes that it helps, to an extent at least.

No idle cash lying around, ever (except for the emergency fund)

In September, I'd built a Personal Finance template on Notion -- it's for sale on Gumroad. If you're a Notion geek, give it a go, you shall not be disappointed :)

Mental constructs around money:

Your salary is XYZ, but your purchasing power is XYZ minus your savings+investments.

You really need to fit this into your head somehow. Force yourself for a month or two, and you’ll be wired to think this way. It’ll eventually affect your spending habits & shopping sprees, and make you more frugal.Every rupee invested, will never be withdrawn.

Unless it is an emergency with no way out, you cannot afford to withdraw money from Zerodha, Binance or Coin no matter how crazy those AJ1s are, or how much “fun” that getaway will be. Make yourself a promise to never withdraw money from your investment accounts unless absolutely necessary.Take a minute to soak in the excitement one notification of “Salary credited by XYZ”, but the next minute, you need to be allocating (read: transferring) your money to your investment platforms or your alt savings bank account. It’s that simple because now right from Day 1 you see only the amount you are allowed to spend in your post-debit notifications.

“Not buying what you want directly, but buying something that will pay for what you want directly”

There’s one important step towards financial freedom that a lot of people don’t talk about & it is – I’ve been doing this with crypto tokens, DeFI Staking, NFTs, IPOs for a while now, and it brings me a sense of relief. And that’s because I’m living life the way I want to, by not sacrificing my present, but also looking after my future self in a way or two.Passive income

You're pretty annoyed (understandably) when you read this word but trust me all i'm striving for right now is a constant source of income where i don't really have to put in time continuously. It requires effort, time & patience but figuring this out early in life will give you a soft-cushion.Understanding your risk appetite

This is something REALLY important to recognise early-in, it only helps you understand where to put your money in. For me, I know i'd like to take a few risky bets because I'm young with little to no responsibility. I don't endorse recklessness, do your own research, but don't shy away from a high risk, high reward deal. You can lose all the money you have today & still figure out a way to make it big in life. It is okay, take risks. (i.e. DeFi, crypto or investing all your savings into your pet project/business etc)

A shameless plug before I lose you: Ripen.in has been helping young adults like you & me to navigate through our adulting problems which revolve around money, career, finance & health through a community-first approach. Ripen squads 2.0 is going live soon and the applications are open. Now is your time to shine & take charge of your life! :D

And a quick list of hacks to make it more complete:

No BNPL, EMI schemes for electronics & luxuries no matter how much you want it. Unless it’s an investment (i.e. you’re a photographer and you want to buy loads of lenses & a good camera), it is not healthy for your own self :/

Rent agreements (real or fake) will ge you tax exemptions. Calculated as the lowest of: actual rent minus 10% of your annual salary – 50% of your salary if you live in a metro city OR the HRA {House Rent Allowance} given to you by your employer)

While investing in Mutual Funds, make sure to invest in ELSS plans (Equity Linked Savings Scheme) – although the results aren’t as exciting, you’ll get a tax exemption on all the money you have invested here. This falls under Section 80(c).

Maximum Exemption: 1,50,000 – You can include your Public Provident Fund (PPF) while calculating the total.

Examples of ELSS funds: Mirae Asset Tax Saver, DSP Tax Saver FundIf you are an intern on a stipend of less than 2,50,000 – you can retrieve all of the TDS deducted (e.g. your salary is 20k/month and TDS is 10% which totals up to 24k, you can retrieve all of it back by filing your IT Returns & seeking a rebate)

Having money might not lead to happiness, but giving away money definitely does (to me, at least). An obvious prerequisite to giving away, is having enough of it.

Don’t wait for it to charge, nahi hoga yaar

Anddd on that note (pun intended), this is pretty much all I know about being financially secure & aware, there's more when it comes investing, where to invest, how I do my research etc, but i think i'll have to prove it to myself first by actually getting it right in the coming year or two. Hope this was a fair start if you were struggling with your money. Take a seat back and leave the rest to the power of ComPounDinG. :p

P.S. Ripen.in's going to launch an "All things money" CBC soon -- don't forget to follow our Instagram!